We Got Everything

You Are Searching For!

SUCCESS STORIES

We Got Everything You Are Searching For!

- Find profitable niches easily

- Find profitable niches easily

- Discover easy to rank for keywords

- Discover easy to rank for keywords

Latest Blogs

New From AffiliateBay

We help you keep up with articles featuring in-depth reviews, expert insights, and exclusive tips on the latest affiliate marketing strategies, tools, and trends.

How to Pitch for Guest Blogs?

SEO Friendly Pagination 2024: Best Practices To Be Followed

9 Best Legal Affiliate Programs In 2024 To Earn Passive Money

5+ SEO Tactics To Boost Organic Traffic & Rankings In 2024

What Are Anchor Texts 2024? How To Write A Good Anchor Text?

Guides

Turning your ideas into reality means working on the technical parts. This is when your blog really starts to come together.

Affiliate Programs

Here are the lists of best affiliate programs that you can join and monetize your website as per your niche.

Popular Niche Business Tools

Semrush

5/5

SEMrush is a comprehensive SEO and marketing tool for research, analytics, and optimization of online strategies.

Jungle Scout

5/5

Jungle Scout is an essential Amazon seller tool for product research, tracking, and data-driven decisions to boost sales.

Bright data

4.9/5

Bright Data is a versatile web data collection platform for businesses, providing reliable and ethical data harvesting solutions.

Thinkific

5/5

Thinkific is a user-friendly online course creation and management platform empowering educators to monetize their knowledge effectively.

Explore More Categories

Take The 28 Day SEO Challenge Now

Steal Your

SEO STRATEGY

Download my 2x intelligent spreadsheets to steal your competitors SEO strategy now!

Take The 28 Day SEO Challenge Now

The 7 Day Ecommerce SEO Strategy To Increase Your Search Traffic!

Download my 2x intelligent spreadsheets to steal your competitors SEO strategy now!

What Our Readers Say About Us...

Hi, from AffiliateBay Team

We’re a team that runs successful affiliate websites, and we’re here to share what we’ve learned. Our team shares practical tips and advice for successful affiliate marketing based on our experience in running affiliate websites. We review various products and services, providing unfiltered opinions to help you make informed purchasing decisions.

POPULAR CONTENT

Browse Our Categories

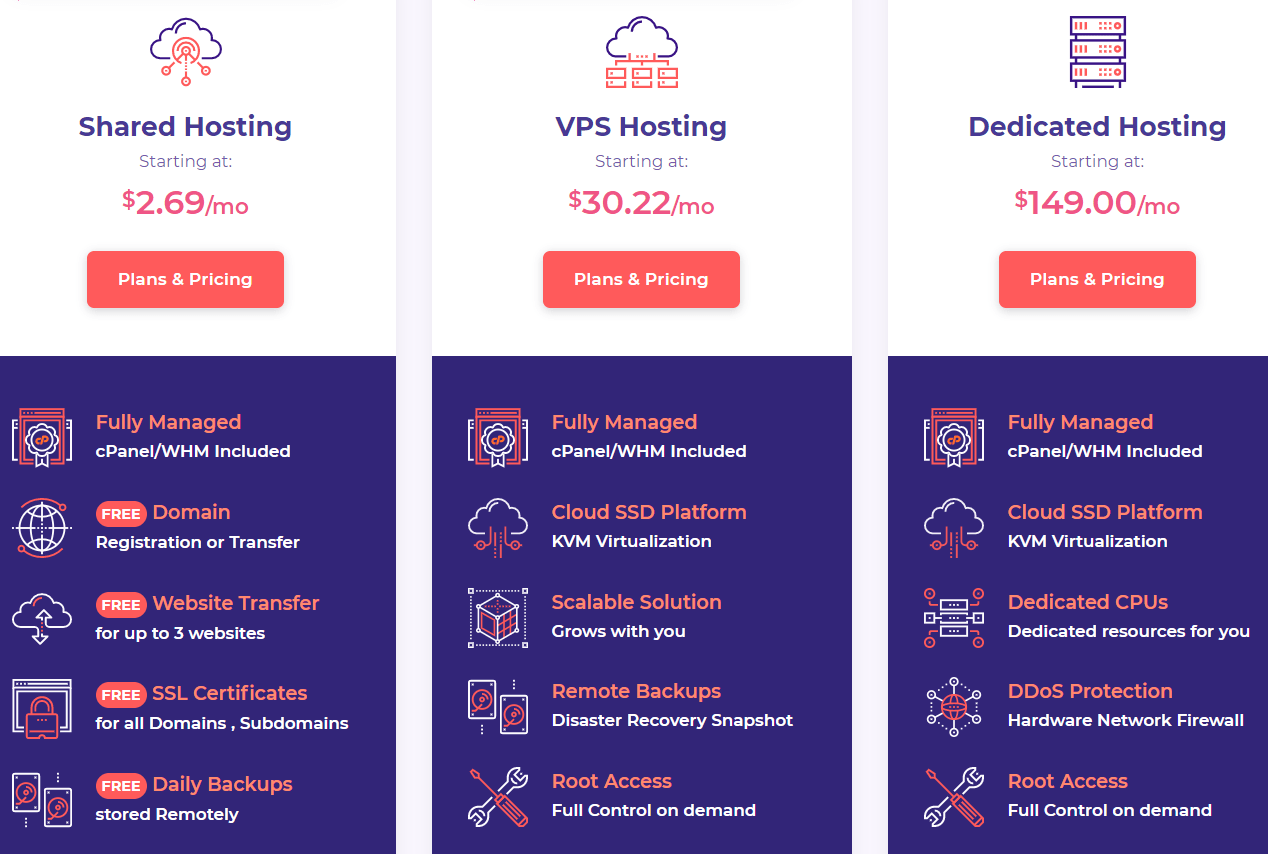

HOSTING

Looking for a new web hosting? Now save a great deal of money using our special coupon codes and deals on the most popular hosting platforms.

EDUCATION

Learn about the top online courses and test preparation. Explore the best deals and honest reviews of popular education platforms and courses.

SOFTWARE COUPON

Get today’s best deals and offers on popular software, services, and online platforms. Save BIG with our new updated coupons.

REVIEW

Explore the word of latest technology with help of our in-depth guides on trending gadgets and tools.The Best Of Affiliatebay

SendWin Review 2024: Is It Best For Managing Multiple Accounts From One Browser?

Updated on: May 17, 2023

IceDrive Review 2024: Is It The Best Cloud Storage Providers?

Updated on: July 7, 2023

WebinarKit Review 2024: Is This Platform Worth Using? (Features, Pricing, Pros & Cons)

Updated on: June 27, 2023

Coach Training Alliance Review (Updated 2024) | My Honest Opinion

Updated on: August 21, 2023

Regal Assets Review 2024: Is The Gold & IRA Company Legit?

Updated on: July 23, 2023

How to Promote Affiliate Links In 2024?- 12 Step Easy Guide

Updated on: January 17, 2024

Affiliate Marketing Secrets Unleashed 2024– Make Passive Money Online

Updated on: January 22, 2024

Become an Affiliate Marketing Pro With Adsterra’s Free Crash Course

Updated on: August 2, 2023

What is a URL? (Uniform Resource Locator) A Complete Guide to Website URLs

Updated on: February 24, 2024

How To Become An Affiliate Marketer In 2024?- 5 Easy Steps To Get Started

Updated on: January 11, 2024

Guide To Find The Most Profitable Niche For Affiliate Marketing In 2024

Updated on: February 9, 2024

Webhosting UK Review 2024: Does It Live Up to the Hype?

Updated on: July 26, 2023

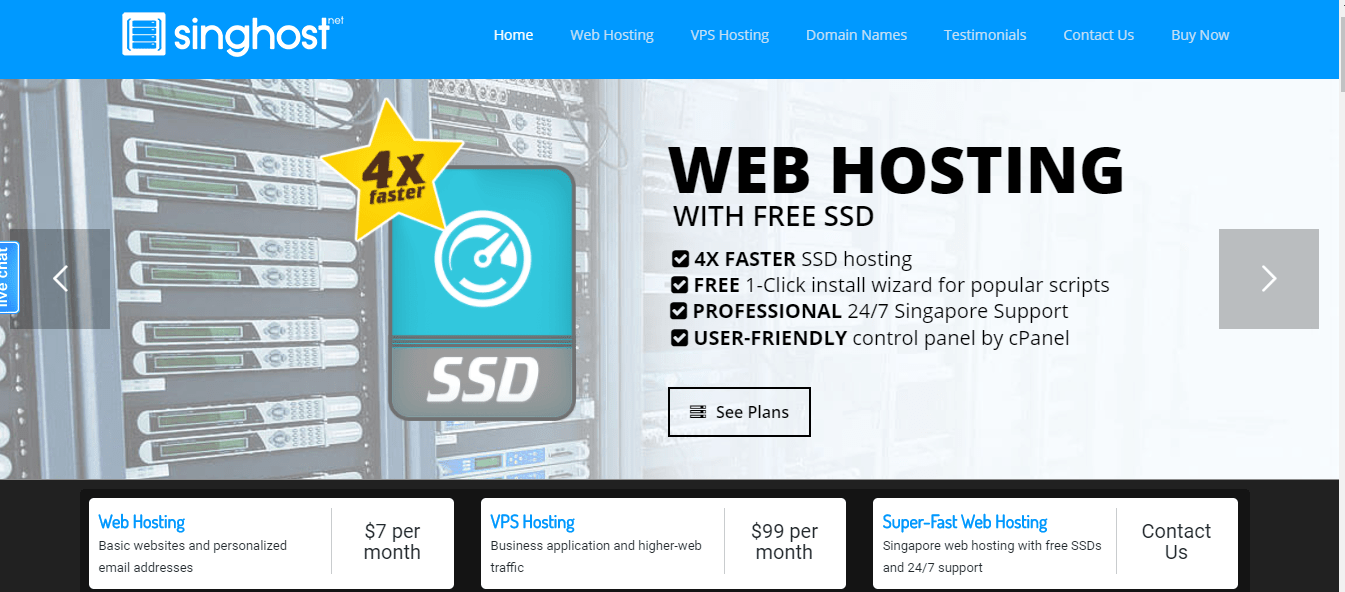

Best Web Hosting Service Providers In Singapore (@ $2.95/mo) 2024

Updated on: September 11, 2023

WPX Hosting Pricing & Plans 2024: Does WPX provide good value for money?

Updated on: July 29, 2023

Why Kartra Video Hosting is the Ultimate Solution For Your Business

Updated on: June 6, 2023

HostArmada WooCommerce Hosting Review 2024– Is It Worthy?

Updated on: August 14, 2023

Namesilo Alternatives 2024– Handpicked For Your Business Needs!

Updated on: August 30, 2022

10 Best Nutra Affiliate Networks in 2024: (Top Paying Offers)

Updated on: August 9, 2023

ADSTYLE Review 2024: Best Native Advertising Network For Publishers?

Updated on: September 22, 2023

Prime Ads Review 2024: Best Crypto Affiliate Marketing Network?

Updated on: September 1, 2023

9 Best Crypto Ad Networks in 2024: Best Crypto Traffic Sources

Updated on: August 9, 2023

10 Best Video Ad Networks For Publishers in 2024: (Top Picks)

Updated on: August 25, 2023

CPA.House Review 2024: Is It Really The Best CPA Network?

Updated on: October 20, 2023

Best Camera For Blogging 2024: By A Blogger & Photographer (Including My Top Pick!)

Updated on: August 22, 2023

How Top 5 Female Bloggers Are Making Money From Blogs? 2024

Updated on: August 13, 2023

How to Find Out How Much a Keyword Costs in PPC Advertising 2024?

Updated on: February 22, 2024

100+ Best Fashion Blog Name Idea 2024: Best 5 Tips & Tricks For Making Your Blog Name Popular

Updated on: August 16, 2023

How Much Does It Cost to Start a Blog in 2024 ? Create a Unique & Beautiful Blog

Updated on: June 5, 2023

Top 15 Best Lifestyle Blogs 2024 : Model For Success

Updated on: August 11, 2023We have been featured on