In this blog post, I am going to highlight Best Forex Accounts 2024.

When entering the Forex market for trading, you need to open an account with a retail broker dealing in the market. These accounts allow you to conduct trade in the Forex market and are called Forex Accounts.

Most of the traders allow new users the opportunity to open a demo account to understand how markets work. These demo accounts are the first point of contact that a new trader has with the Forex market.

Depending upon the trader’s enthusiasm, he or she can learn a lot about the Forex’s standard functionality. Thus, getting more equipped for entering the real market.

These Forex Accounts come in various types. Also, choosing the account type is one of the critical decisions you’ll need to make when entering the world of Forex trade.

This choice of Forex Account is crucial because different account types come with various features. Moreover, different account types accommodate different needs, and you need to discover a Forex account that best suits your requirements.

Different account types offer various features according to individual requirements. These distinct features make it essential that we understand different features that different account types have. This blog will take you through various elements of these forex accounts.

Content Outline

3 Best Forex Trading Accounts 2024

What are the Broad Categories of Trading Accounts?

The forex market is one of the most volatile markets globally. The forex market is different from other markets because it allows individual traders to challenge bug hedge funds and various banks on equal footing.

Irrespective of your trading objective, all you need is a valid account, and you are good to go. There are three categories of Forex Trading accounts from which you can choose according to your requirements. Let’s look at these accounts more closely.

1. A Standard Trading Account

These types of accounts are the most popular account type famous among individual traders. By getting a standard trading account, you get access to the common lots of standard size. The worth of these standard lots is $100,000.

However, you need not worry about making a $100,000 investment at one go. This trading with a lower amount than the standard lot is possible with the help of leverage. As mentioned above, you only need a $1000 in your margin account to trade a single standard lot.

Pros of a Standard Forex Trading Account

-

High-Quality Service

Standard accounts require the traders to pay their investment amount upfront. This prepayment of investment makes the trading accounts are special for the brokers.

Considering this, brokers provide exclusive benefits and services to the traders, which might or might not be available with the other accounts.

-

Potential of Gain

Consider that you own a $100 pip, and the market moves by 50 pips in a day. In such a situation, you’ll gain $5000 in one day.

While this size of gain seems unrealistic, but it is true. It is worth mentioning, this size of the exponential increase is not achievable using other forex accounts until you trade with the more standard lots than one.

Cons of a Standard Forex Trading Account

-

An Upfront Requirement of Capital

You need to fund your Forex standard account before you can start trading. This upfront requirement of capital is the biggest con of a Standard account.

-

Potential for Loss

When you have the chance to cover such a huge amount of profit, there are also chances that you might end up losing such gigantic amounts as well. So, it is advisable to use due caution while trading using a standard account.

2. Mini Trading Account

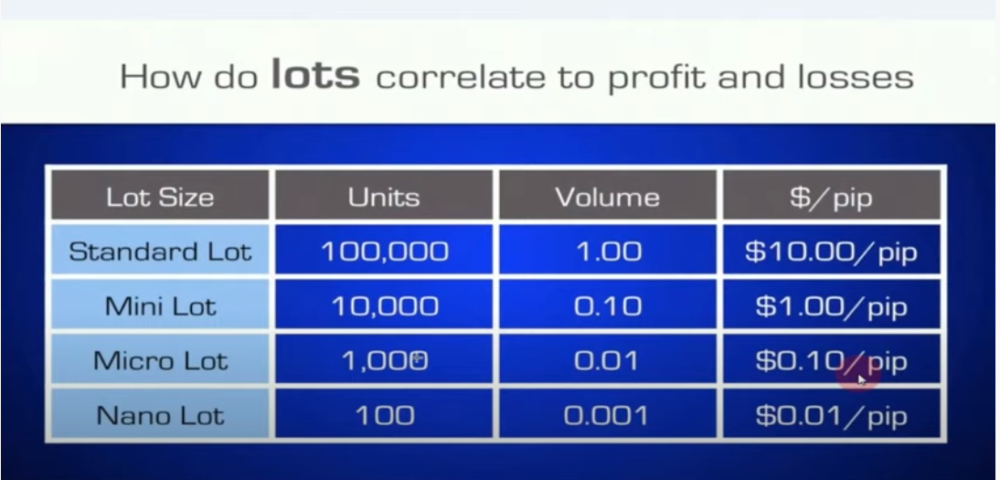

Allowing you to deal in lots which are 1/10th the size of a standard account, Mini Trading accounts as the name suggests is about trading in mini lots.

These accounts are specifically beneficial for those traders who are new to the market and want to experiment to understand the functionality of the market.

Since these accounts are an excellent way to bring in new clients for the firm, most brokers who offer standard accounts also provide these accounts.

Additionally, these accounts are most suitable for experienced traders who have substantial funds to back up their trades.

Also, some accounts are known as Micro Accounts that allow you to trade in the lots of $1,000 supporting pip movement of 10 cents per point. These accounts are available with an initial investment, which is as low as $25.

Pros of a Mini Forex Trading Account

-

Low Level of Risk

Because you trade in small lots, the risk you assume is significantly lower than standard accounts. This low level of risk makes these accounts highly beneficial for new traders who want to experiment and old traders who want to try new trading strategies in the market.

-

Requirement of Low Capital

Coming with a leverage 400:1, you can get one of these mini accounts with an investment, which is as low as $250.

-

Flexible Portfolios

While you have one big lot of $100,000, the risk that comes with is relatively on the higher end. Mini accounts permit you to own multiple small lots that you can optimize according to your risk management policies.

Moreover, owning five small lots is always better than owning one big lot, at least in most cases.

Cons of a Mini Forex Trading Account

-

The Upfront Requirement of Capital

The mini trading accounts come with capital requirements which you need to pay before you can start trading. These investments can vary from $2,000 to $10,000 from broker to broker.

-

Potential for Loss

While there is potential to gain profit by trading in small amounts, likewise, it also involves potential risk, which can come as a blow to the new traders.

-

The Low Reward for the Risk Undertaken

Because the profit is directly proportional to the amount of investment, the amount of profit that an investor can earn is also low.

3. Managed Forex Trading Account

All you have to do in these types of accounts is to provide investment and portfolio objectives like the goals for profit and risk management ratio.

The fund managers take trading decisions. These accounts are similar to managed stock accounts where stockbrokers make the trading decision on the investor’s behalf.

Additionally, there are two categories of managed forex trading accounts.

-

Fund Pools

In these accounts, your investment is added to a larger pool consisting of money from different traders. Once the trade is undertaken, the resulting profit or loss is divided between the investing traders according to their shares.

-

Individual Accounts

These managed accounts are highly useful for individual traders who do not want to make investing decisions. These types of Forex accounts are preferable for new investors who lack knowledge about the markets.

-

Discretionary Accounts

These accounts generally come with a lot of restrictions, including restrictions on the withdrawal of funds. In a discretionary account, you pay the account manager a share of profit for his services of investing on your behalf.

-

Automated Accounts

Providing you with API access makes these accounts highly effective when you want to automate your trading activities. While you can also manage these accounts manually, you can also set your parameters, which will automate the initiation and liquidation of trades.

Pros of a Managed Forex Trading Account

-

Trading by Experts and Market Specialists

These accounts are handled by market specialists who have years of market experience. You are able to trade in the market through their knowledge and get more profit.

-

Suitable for New Investors

These accounts are most suitable for new investors who are just entering Forex trading and lack the experience.

Cons of a Managed Forex Trading Account

-

Lack of Control

When you go for a managed trading account, you don’t have any control over the investment decisions. All the decisions are made on the fund manager’s discretion.

-

Withdrawal Limitations

These accounts generally come with withdrawal limitations making the funds inaccessible to you at the time of urgency.

Things to Remember While Choosing the Best Forex Account?

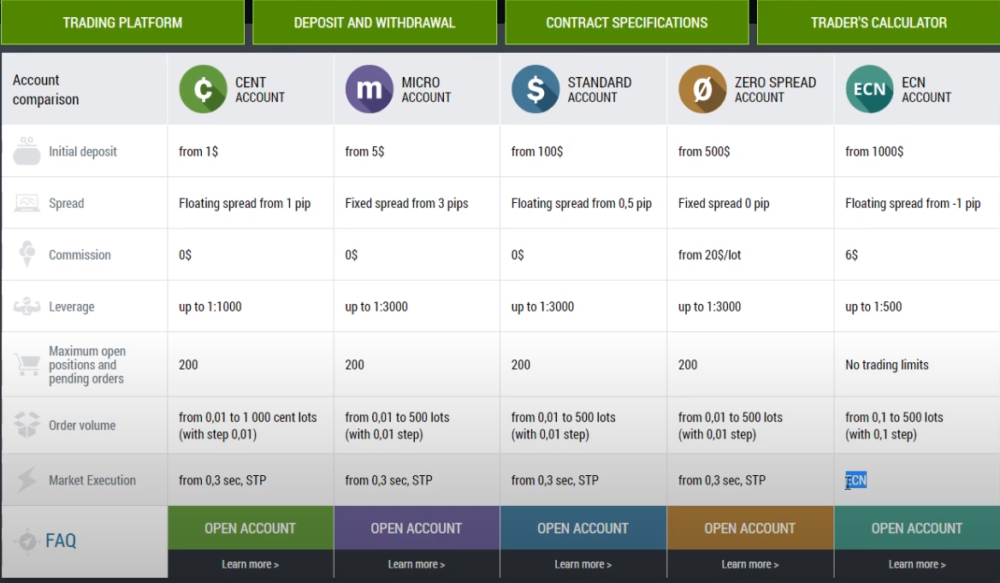

Minimum deposit amount, amount of spread, access to platforms, and leverage are some of the key elements which cause the difference between various accounts.

Let’s look at some of these elements closely.

-

Amount of Minimum Deposit

One of the primary differences between different account types is the amount of minimum deposit.

While some brokers offer you accounts with a minimum deposit as low as $1, some brokers require over $500 as the minimum deposit. You must browse your options and discover the broker, which offers an account that matches your budget for a minimum deposit.

-

Spread

A Spread is the amount difference between the asking price of the broker and the bid price. Different Forex accounts have either variable or a fixed spread.

It is important to note that interbank rates influence the variable spread and are generally on the lower end. However, the accounts which offer you low spread also have commission charges involved.

Additionally, it is also worth noting that a fixed spread is higher because of the mark-up. These mark-ups compensate the brokers for not charging an additional commission.

While swing traders are least bothered with spread, they can go for both fixed and variable spread depending on their needs. However, if you are a scalper whose trading strategy depends highly on the spread, you might prefer a lower spread.

-

Amount of Commissions Chargeable

Commissions refer to the charges that you pay to your brokers for the services rendered. From minimal to high commission fees, there are various types of brokers.

It is for the best for you to find a broker whose commission fits in your budget. Also, low commission charges have a significant impact on your business in the long run.

Additionally, some brokers also offer zero commission Forex accounts. These brokers make up for zero commission through spreads, which are marked up. An optimum combination in the best accounts is to have low spreads and low commission fees as well.

-

Availability of Leverage

Leverage refers to the facility of availing additional funds from your broker, which allows you to take the positing in the market, which is otherwise impossible. It is important to note that leverage is like a double-edged sword.

While it allows you to increase your profits significantly, it can increase your losses significantly as well.

In case your trading objective needs some amount of leverage, make sure to discuss this with the broker before opening up an account.

Consider someone offering you a 3:40 leverage account. It merely means that you can get a leverage of $40 for every $3 that you invest.

-

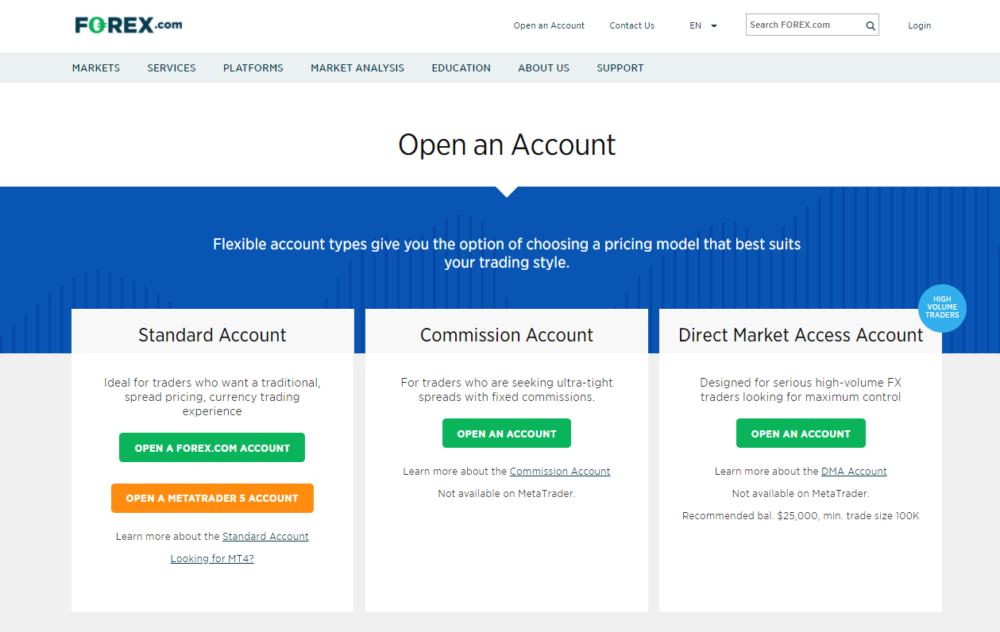

Different Platforms for Trading

There are various platforms that you can use for trading. The most common of all the platforms is MetaTrader, which is accessible by almost every account.

But if you need a specific platform to trade, make sure to find an appropriate account that allows you access to that particular platform.

-

Availability of Trading Instruments

Forex is not the only instrument in which you can trade. There are various other instruments like commodities, stocks, metals, cryptocurrencies, indices, and bonds, to name a few.

In case you are interested in trading into other instruments, you need to choose an account type that allows you that facility.

-

The Model of Execution

ECN broker model, Market Maker model, and STP execution are some noteworthy market models you need to be aware of. These different models provide you with different execution-style and need to be chosen carefully.

ECN broker model is the most popular execution model in the market because it allows for the most favorable conditions for trading, followed by STP and Market Maker.

An ECN or an STP broker forwards your requests directly for execution to the liquidity providers allowing the minimum amount of slippage in the process.

However, it is generally known that a Market Maker broker might conflict with your trading style.

Availability of Additional Features

In case you are looking for particular special features or just want to have something extra, you must discuss it with the broker.

While most of the brokers offer similar additional features across all types of accounts, you can still make special requests. Considering the size of the investment you plan to make, and the broker might oblige you with your request.

These additional features might include webinars and seminars, market analysis, educational material like books and videos, and trading tools, to name a few.

Availability of Other Accounts

Most brokers offer demo accounts to the newbies who are just beginning to explore the forex market. These accounts have a complete setup with virtual money and real-time market data to make you accustomed to real-market trades.

Additionally, if you have a special requirement like a Muslim account to comply with Sharia Law, you can also discuss it with your broker.

Quick Links

- Forex Scams– A Detailed Guide On How To Avoid Them

- Forex Economic Calendar And How To Use Data Provided By Them

- 6 Different Forms of Forex Charts That Every Trader Should Know

- What is Forex Broker And How Can We select Best Forex Broker?

- Sentiment Analysis– Best Tips & Strategies

FAQs | Best Forex Accounts

🧐 What are the minimum investment that you need to open a Forex Trading Account?

Different forex trading accounts come with varying requirements of an investment. You can open a live forex account for as little as $25 through some brokers.

🤷♂️ Is it safe to go for managed forex accounts?

If you are considering investing in the forex market, you need to understand that there is nothing called as safe. The forex market is highly volatile. How much profit you gain depends on the experience of the individual who handles the funds.

🙋♀️ What is the most suitable account type for a beginner?

The foremost recommendation for a beginner is to open a demo account to understand how the market actually works. In case you want a live forex account, you can go from a mini account to a managed account, depending on your preference. You can either learn from the first-hand experience by investing small or benefitting from someone else’s experience and expertise.

🤙 Is it best way to manage multiple forex accounts at once?

Since the forex trading is volatile type of trading and the market keeps fluctuating all the time, it is not good practice to use multiple forex accounts at once.

🙇♀️ How many forex trading accounts can you have at once?

You can have any number of forex accounts at a time, but the experts generally prefer to have a maximum of 2 forex accounts.

👉 Which are basic Forex trading account?

The basic types of Forex accounts are: Cent account Mini account Micro account Nano account

🤨 Which are best sites to open Forex acount?

Some of the best websites to open your Forex account are Trade12, MetaTrader4, AvaTrade, etc.

🤔 Is Demo Forex account legal?

Yes, the Demo Forex account is absolutely legal and it is generally for beginners who are new to trading and want to learn it.

👍 How long should I trade in demo mode in Forex before I start the real trading?

There is no specific time for which you need to trade with a demo forex account. SInv=ce, demo account is for learning trading and does not involve any real money, the plans you used in the demo account may not necessarily work in real account. So, use a demo account unless you totally learn trading and are willing to risk money.

🤓 Can I trade forex with $10?

Yes, you can do Forex trading with as low as $1. You just need to find a proper broker within your budget.

🤨 Do we need Forex Broker?

We need a Forex broker to open an account in Forex for trading purposes. This is the first step to opening a forex account

🤟 What position size is optimum for $500, $1000, $5000, and $20,000 Forex accounts?

It is totally up to you, how much money you want to invest in. But since the forex trading is extremely volatile and dynamic, it is not a good practice to invest a lot of money.

🙇♀️ What is difference between micro and standard forex account?

The standard forex account requires a minimum deposit of at least $500 whereas the micro forex account does not require any minimum deposits.

🤔 What is difference between micro and mini forex account?

The micro and mini forex account both are for smaller units. These accounts are used by beginners who are new to trading. Mini account starts with 10,000 units whereas micro account starts at 1000 units.

👍 Which forex account brings more profit?

The standard forex account that requires a minimum investment of 100,000 units brings the most profit of $10.00/pip.

👍 Does demo forex account bring us profit?

The demo forex account is for learning purposes and does not involve any real money. Hence, it does not bring profit in terms of real money.

Conclusion | Best Forex Accounts 2024

You need to factor many elements while choosing the most favorable account type. Trader’s experience, management of the account, and the number of funds the trader wants to invest are some factors that highly impact this decision.

While you can choose a demo account to get the hang of the market or try new trading strategies, taking a demo account is always wise.

These demos allow you to understand and browse various features that the chosen account is offering.

By doing so, you can get a better understanding of whether the account in question fits your needs or not.

Additionally, if you are a seasoned player in the Forex market, you will already know what features you are looking for. If that is the case, you can directly discuss with a broker your requirements.

Generally, these brokers will have tailor-made accounts that will fit your needs. However, if you feel that the feature is missing, you can implore the broker to provide you with the additional feature.

Brokers generally special requests from the customers if the amount of investment that a trader plans are substantial.

Choosing the perfect Forex account might become a daunting task if you don’t know what you are looking for. So, before you go out to finalize a Forex account, make sure that you have done your research.

You need to be aware of your needs and requirements to discuss it with your broker. It would help if you did a thorough cost-benefit analysis to find the perfect trading account for you, considering there are many available options.

Hi,

I’m looking for the best blog to post one of my client’s articles. During my search, I came across your blog. Well, I found that the posts on your blogs are quite edifying and admirable to read. So, I’d like to suggest your blog ( https://www.affiliatebay.net ) to my clients. My articles and links will be General not related to Casino,Loan,Adult and Gambling. So let me your price in $ without adding casino prices.

Now, I’m reaching out to you to ask if you are interested in publishing guest post articles on your blog without sponsored tags. If so, please devote some time to tell me your thoughts in your busy schedule.

I hope our post will definitely bring valuable information to your avid readers.

I’m eagerly waiting to hear from you soon.

Thank you,

Regards