In this post, we have shared the Motley Fool Review 2024, which is a great Stock Advisor Platform.

The Motley Fool is an excellent place for new investors to start, offering articles and advice on everything from how to invest in stocks to how best to manage your retirement savings. They also offer a variety of tools that allow you to track the market as well as keep up with what’s happening at any given time.

If you’re looking for a great resource or want some tips on investing, check out Motley Fool today! With their guidance and resources, you’ll be able to build a solid foundation for your financial future.

Content Outline

Motley Fool Review 2024: Should You Choose This Stock Advisor Program?

Before answering the question ‘Is the Motley Fool worth the money?’, let me tell you that I have a first-hand experience of their service for more than four years now.

After continuously following their stock advice, I can confidently say YES, Motley Fool is worth the money, especially when you are paying just $199 a year for specific stock advice, which has given me an average return of above 80% in the last four years!

I have bought all the stock picks that Motley Fool has recommended since 2016, and my average returns are around 81% as of 2024. What impressed me more is their financial advice and understanding of stocks that usually outperform the market every year.

Motley fool is a financial education website that provides free articles, videos, and podcasts on everything related to investing. They also offer a stock advisor platform for those who want to invest in individual stocks.

After seeing the results, I wanted to write a review on Motley Fool for the benefit of people who have been thinking of subscribing to the Stock Advisor Program.

Are you on a plan to subscribe to the Motley Fool service?

In this article, I will explain to you, what you can expect, based on my experience and how it helps in understanding the stock market.

About Motley Fool

Motley Fool is co-founded by David and Tom Gardner, who started their flagship service called Motley Fool Stock Advisor that provides premium stock-picking advisor service to its subscribers.

The main goal of this company is to beat the analysts and the predictions of Wall Street fat cats by its stock recommendation.

The program gives two stock recommendations every month, one each by the co-founders, in the form of a detailed email newsletter sent to the subscribers. The email newsletters come with the details of potential risks and returns of the recommended stocks.

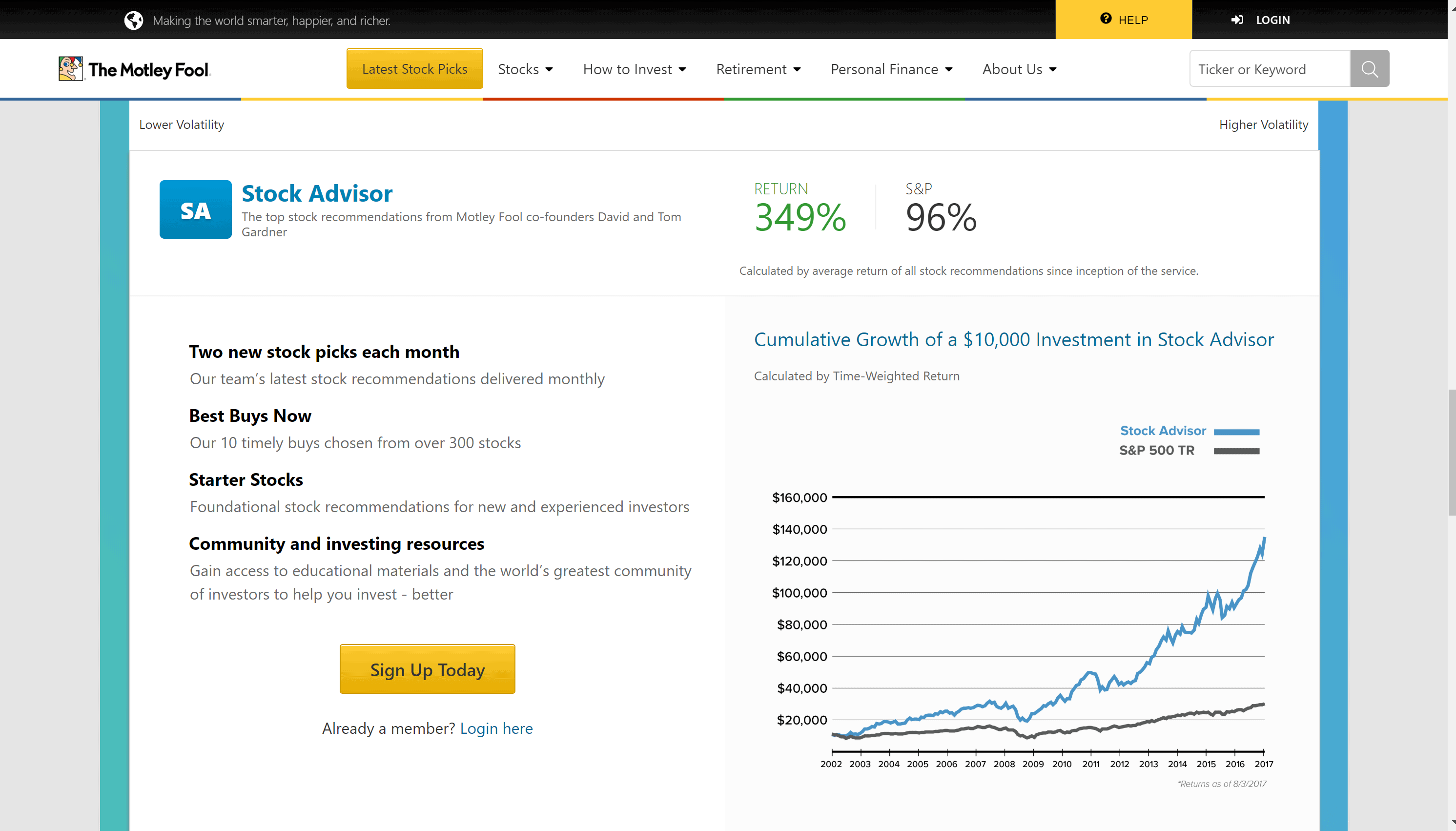

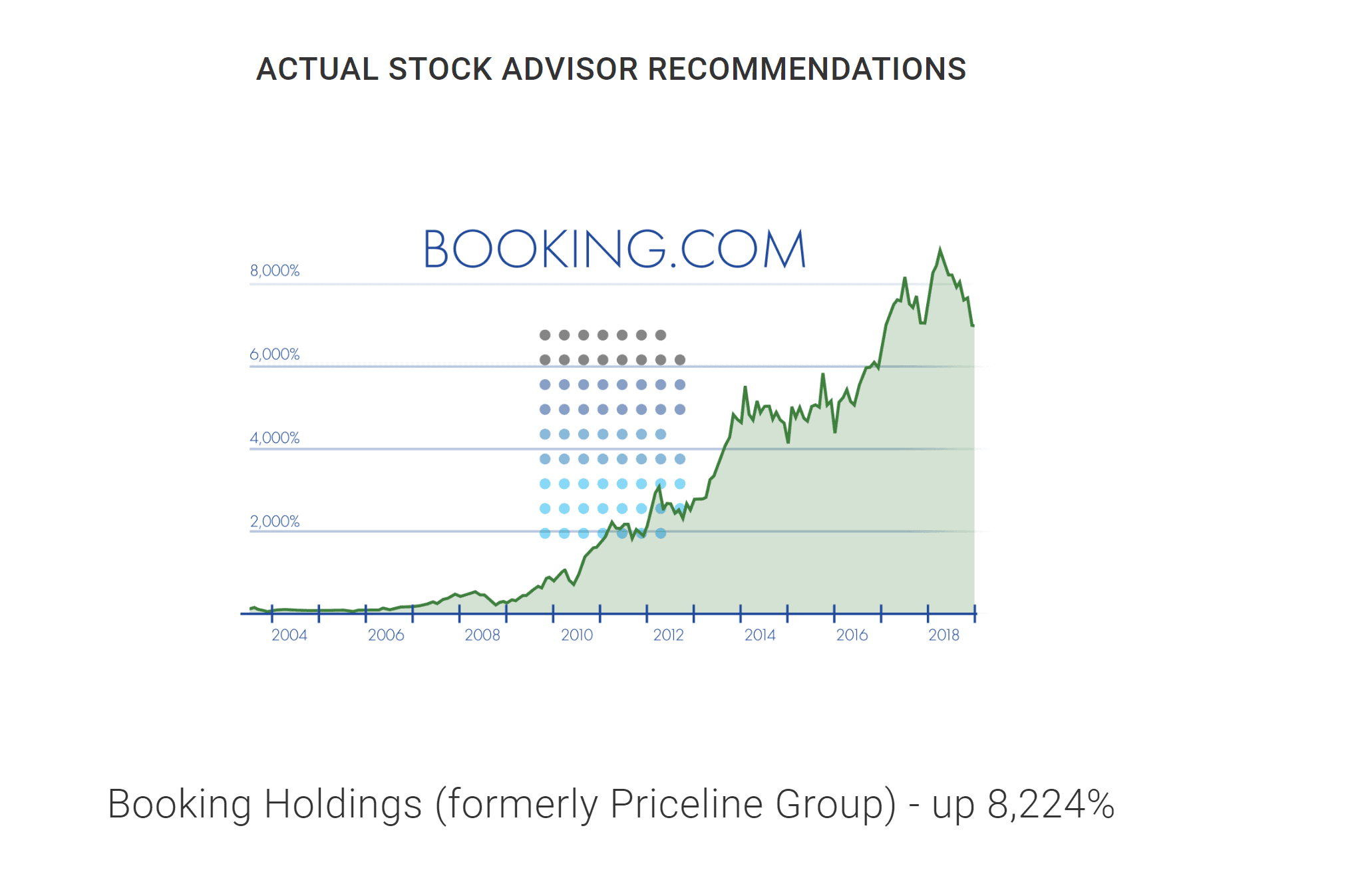

Motley Fool has been performing excellently well in their financial stock-pick advice since 2002. Most of their stock picks have outperformed the market by at least 25%.

From the initial days till March 2018, Motley Fool stock picks have returned 343% to the traders in comparison to 79% returned by the S&P 500 index.

In other words, if the investment in stocks recommended by this company was $5,000 during its inception, by March 2018, it had become worth $85,000 while the same investment in S&P 500 index had grown to $20,000.

📈 Motley Fool Stock Advisor Suitability

If you ask me about the suitability of this Stock Advisor, I would say it is not for all. That doesn’t mean it’s performance is not up to the mark, but mainly because it may not suit everyone’s perspective.

It advises you to develop a diversified portfolio comprising of the recommended stocks that you should hold for more than three years, at least. It doesn’t claim to make anyone quick rich and doesn’t guarantee returns on any of its stock pick recommendations.

Also, it is not for investors who expect performance similar to the broader indexes like the S&P 500.

Every investor comes with a different risk tolerance level. It is for the investors to decide whether the Motley fool’s stock pick recommendations match their goals and strategies, and accordingly take a call on each of the stock pick advice.

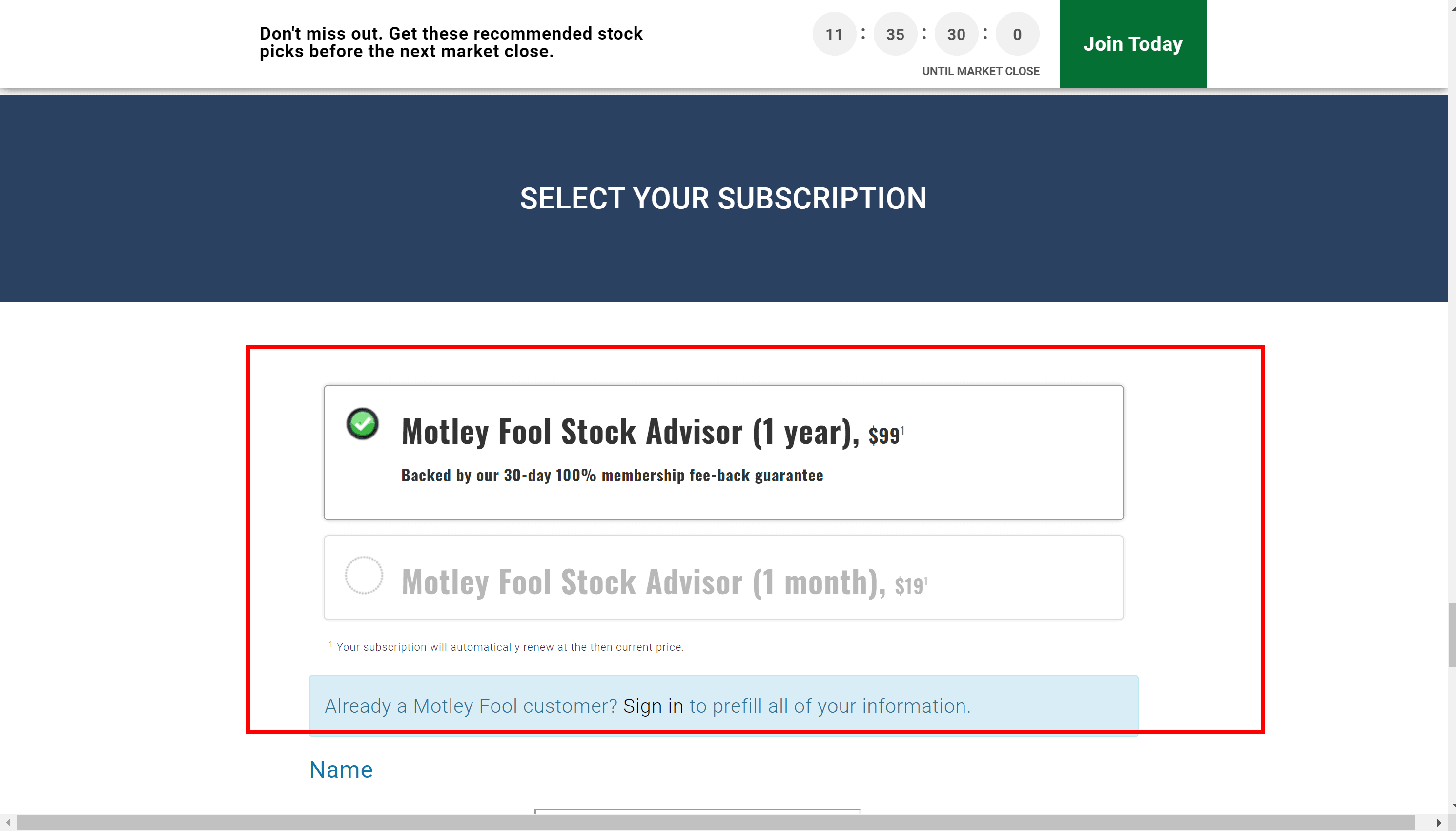

In the case of the annual subscription, if you start a subscription on 10th January, each year, on the 10th of January, the subscription should be renewed.

Sometimes, the company offers an annual subscription at a discounted rate, especially for new customers and monthly customers.

Please note Motley Fool does not refund your amount if you cancel your subscription.

However, you may use the balance amount for any other premium services offered by the Motley Fool. Grab a 50% Off coupon on Motley Fool Review 2024.

🥇 The Motley Fool Stock Advisor Program Benefits

Here are the essential features of the Stock Advisor Service, discussed below.

1. Regular Recommendations

If you subscribe to the stock advisor, every month, you will receive two recommendations, one each from the co-founders in the form of an email newsletter that consists of full details about the stock along with the potential risk. You would be able to see all the recommendations in your stock advisor account.

2. Best Stocks to Buy

The dashboard of your stock advisor account will list out the 12 best stocks that you could consider, usually of blue-chip companies or group companies.

These 12 stocks get updated every Thursday and include 6 stock picks each from both the co-founders. Interestingly, some of these stock picks like Amazon feature in the best-stock to buy list repeatedly.

3. Starter Stocks

The stock advisor gives the right investment advice by recommending starter stocks meant for beginner investors who have just started to build a portfolio.

Usually, the starter stock list gets updated at least once in the year; sometimes it could be more than one as well.

4. Motley Fool Stock Advisor Email Subscription

The stock advisor regularly sends email newsletters that may include either new recommendations or an analysis and review of a particular stock or some trade alerts to sell the stocks in parts or full.

You don’t have to worry about subscribing to the newsletters separately, as signing up for the stock advisor service will automatically enroll you for the newsletters.

However, please keep in mind that if you want to unsubscribe from the newsletters, the only way is to cancel your subscription itself.

5. Stock Watchlist

Like any other brokerage company, Stock Advisor also provides you with the watchlist feature, which is quite useful for easy analysis of the movement of individual stocks that you want to watch. All you need to do is to search for the script and add tickers to create a watchlist.

6. Favourites

The favorites feature enables you to collect your favorite stocks in another bucket for easier real-time analysis that you may have already added to your portfolio or have been watching.

You could even link your brokerage account with the Stock Advisor account that allows you to import your holdings and provides you with the ‘buy’ and ‘sell’ options.

7. Scorecard

The scorecard is another feature that helps you visualize the stocks that you have taken a position in. It updates the data related to your stocks, including current price, purchase price, purchase date, day changes, your returns since the buy, returns in comparison with S&P 500 index, etc. during the trading hours on a minute basis.

8. Optional Email Subscriptions

When you subscribe to the Motley Fool, you may even subscribe to the optional email newsletters that include scorecard updates, special offers, and stock-up content.

9. Performance Tables and Charts

The performance tables and charts are a section filled with data that provide complete details of recommended stocks along with their performance over the period, including the risk-return scores.

The data enables you to analyze the fundamentals of the recommended stocks, along with the price history before taking a buying call.

10. Premium Research Reports

When you subscribe to the Stock Advisor service of Motley Fool, you can get access to the reports of the premium research conducted by the company.

You would receive an email when there is a good time to sell stocks.

Usually, these reports focus on the trends in the industry that may influence the upcoming and existing stock picks of Motley Fool.

Here is a video of Motley Fool by Glassdoor:

11. Premium Articles

Motley Fool keeps publishing premium articles, more like a summary of premium reports in easily readable formats that are premium in nature and cannot be accessed unless you have subscribed to the Stock Advisor.

12. Stock Investment Screener

It is another commonly used feature by market watchers that helps you screen the price volatility, asset class, dividend yield, and the marketing sector.

13. Premium Discussion Boards

The Stock Advisor allows investors to exchange the investing strategies, tips on recommended stocks, etc. on their premium discussion boards. Motley Fool has around twenty-plus discussion boards meant for the members.

You need to create a user name to participate in the discussion boards.

Who Should You Choose Motley Fool?

Motley Fool is best suited for:

- Individuals who are willing to invest for long term

- Individuals who understand investing individual stocks in mutual funds.

- The ones looking to invest in stocks for months.

Further, it will give you the right advice if you are looking to beat the market.

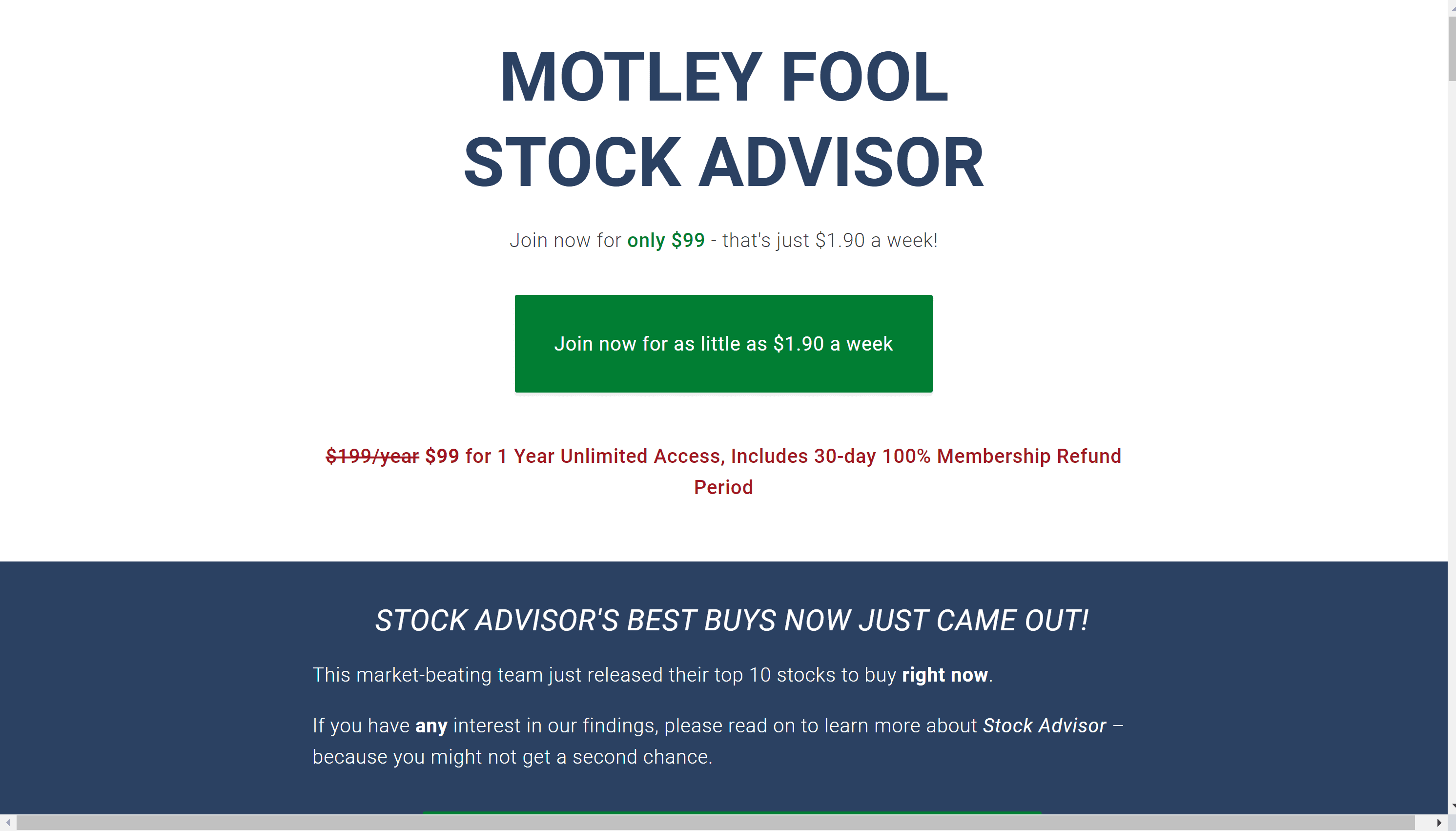

About Motley Fool 💰 Price $99 😍 Pros Analysts update recommendation changes on their picks 😩 Cons Technical traders may not find the content timely or actionable Verdict I have bought all the stock picks that Motley Fool has recommended since 2016, and my average returns are around 81% as of 2019.

Pros & Cons

👍 Pros:

Most of the investors choose Motley Fool company for the following reasons:

- It doesn’t demand aggressive trading and is not meant for day traders. It is designed to benefit from long-term financial market movements.

- There is no obligation to renew the subscription. You can simply cancel the subscription at the end of the scheduled period to stop the auto-renewal.

- As a new subscriber, you can get access to all the active recommendations of Motley Fool, since its inception in 2002, which helps you build your diversified portfolio.

- It even provides you access to the closed recommendations of the Stock Advisor.

- The premium discussion boards provide great value addition as you can exchange strategies and learn from the other members who could be veteran investors.

- Access to the premium reports and premium articles is another advantage of subscribing to their stock advisor program.

- This Stock Advisor Program is time-tested and has proved to be worthy of changing market conditions.

- Subscription is not mandatory to get access to all the premium content. There are specific premium contents that are available for non-members as well.

👎 Cons:

Despite the huge advantages and value addition, you may also want to consider the disadvantages before subscribing to the Stock Advisor. The major disadvantages are:

- The Stock Advisor program is one of the many premium services offered by Motley Fool. It is their flagship service, however, not the complete package.

- Subscribers cannot opt-out of the email newsletters unless the stock advisor subscription is canceled.

- Annual subscription at a discounted rate is not guaranteed for future renewals.

- Canceling the subscription before the end of the scheduled period doesn’t offer any refunds or prorating. However, if you cancel the annual subscription in the first 30 days, you are entitled to a complete refund.

- There is no Motley Fool mobile app yet.

Morningstar

Investopedia

Seeking Alpha

Also Read:

- Olymp Trade Review: Is It A Legit Trading & Investment Platform?

- Trade-Ideas Promo Code

- Understanding Money and ETH Exchange

- Gryfin Promo Coupon Codes

❓ FAQs: Motley Fool Review 2024

🔥What Is Motley Fool Stock Advisor Program?

The purpose of Stock Advisor program is to create the best stock recommendations and help average investors beat the market.

💲💲 How much does Motley Fool Cost?

Motley Fool service cost an annual subscription at $199 or a monthly subscription at $19.

✅How to find best stocks to buy?

The dashboard of Motley Fool account will list out 12 best stocks that you could consider, usually of blue-chip companies of group companies.

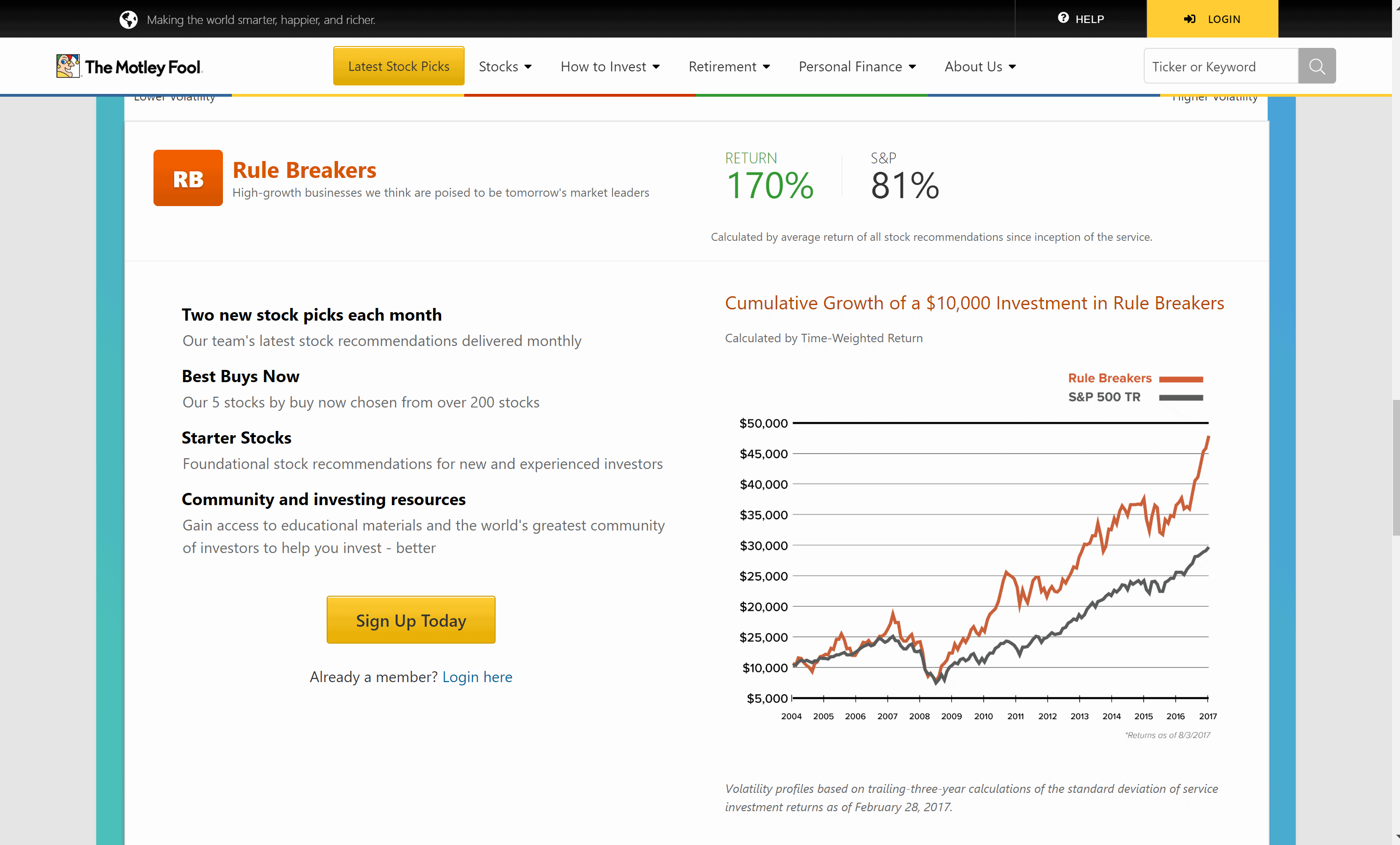

🏆 Is Motley Fool Rule Breakers any good?

Yes, Motley Fool rule breakers is a focussed newsletter for the right stock picks. It gives you advice on growth stocks to beat the market.

❓ Is The Motley Fool legitimate?

Yes, the Motley Fool is completely legit. The company seeks to make people happy, make them laugh, and make a lot of money for their customers. You don't have to spend a ton of money on a subscription service to get started.

👍 What are the alternatives of Motley Fool ?

Motley Fool, Yahoo! Finance, MetaStock, Morningstar, Bloomberg.com are some of the alternatives of Motley Fool

🧐What does Motley Fool do?

The Motley Fool's goal is to make the world smarter, happier, and richer. Other companies might make people smarter or happier, but they want to do all three of these things. To do this, they provide good advice on business and investing to people who are part of the Motley Fool - a group of investors.

Conclusion: Motley Fool Review 2024

Investing in the stock market is a risky affair. Motley Fool doesn’t claim or guarantee that its recommendations will give returns.

As an investor, you would be prepared to hold the stocks you buy for a more extended period, which can go above three to five years.

You should also be prepared that some recommendations may even turn out dud. Therefore, it is always advisable to have a diversified portfolio with at least a dozen different stocks.

If you have the patience to wait for a long term, if you have the willingness to diversify your portfolio with outperforming stocks, if you are ready to spend around $99 to $228 a year for getting valuable recommendations, then you may want to subscribe to Motley Fool Stock Advisor today.

I hope you have liked the Motley Fool review, which offers a great stock advisor program and a set of rule-breakers to help you achieve your stock recommendations.

Motley Fool Review is NOT the best. It doesn’t do what it’s supposed to do and I don’t recommend using it if you’re looking for a good investment service.

The email newsletters come with details of potential risks and returns of recommended stocks, but nobody can accurately forecast when stock prices will go up or down so I think they should just let people invest in the dumbest stocks possible every month on these things.

Motley Fool is the best stock-picking advisor I’ve come across. It’s so easy to unsubscribe if it doesn’t work and guess what: I was up more than 30% in 2013, which is impressive considering my S&P 500 Index stocks underperformed by about half that amount.

I find it valuable also because of how they structure their recommendations.

They give you two shares every month: one from Tom and one from David – a blend of high risk with some solid opportunities for growth potential.

Who says the one percent has all the fun? The Motley Fool Review is an online newsletter service for those who want to get rich by investing and outperforming Wall Street. Every month, you’ll receive two stock recommendations from co-founders David and Tom Gardner that come with details of potential risks and returns on the stocks.

I love the Motley Fool, which I’ve been getting for months now. The monthly two stocks picks are always something that’s on my radar and David and Tom can really pick a winner!

The small downside to this service is that you have to pay 10 dollars each month but it’s worth it for such good quality work

Motley Fool strives to beat the analysts and Wall Street fat cats by its stock recommendation. They provide two recommendations annually, one each by co-founders David and Tom Gardner. So, don’t miss out their email newsletter with detailed information on stocks and they send it every month!

I highly recommend this stock advisor for anyone who is looking to make a smart investment. The program gives two recommendations each month, one by the founders themselves, and since it’s been founded in 1993 they wisely know what they are doing. I subscribed mostly because of their return on total capital investments giving me great hopes and expectations. There’s also an integration system just like one designed by Patrick O’Shaughnessy that monitors portfolio positions on a daily basis which sets my mind at ease – knowing all will be well from now on no matter what happens. If you’re into stocks then you should really take a look here before heading to another site.

Founded by two successful brothers and recent best sellers, The Motley Fool is a place for people with common sense and the love of investing to come together to do their own research, provide advice and support each other. This initiative offers consumers access to unbiased information about the state of stocks in an easy-to-understand format that can be used as a decision tool. The content on this website is designed for both new investors looking for some financial help or guidance as well as experienced players who want fresh stock recommendations based on what they know about specific companies. highly recommended.

I used to work really hard for my money in order to grow it. Then I came across Motley Fool and they handled everything for me, I was very pleased with their service and still I am at my present time. The best part of this company is that you can find them on the internet easily by googling “motley fool reviews”. They are highly ranked among other things because they have always been right about stocks with their predictions and insights from people who know what they’re talking about.

Motley Fool’s Stock Planner is a service that provides specialized stock-picking advisors who provide two monthly recommendations, one by each father. It gives in-depth advice about when to buy and sell stocks based on their recommendation history and analysis of the current market trends. No nonsense writing style for every day people; stellar experts with 100% success rate in the last decade; has provided investment opportunities in big names such as Google, Amazon, Netflix.

Motley Fool is co-founded by two guys who are determined to beat the Wall Street fat cats by giving their subscribers a monthly newsletter with stock recommendations that include a detailed email.

I’ve never seen anyone more passionate and knowledgeable about stocks than these fellows. They have so much knowledge, and they’re always willing to pour it into people’s heads for free! And not only are they nice enough to spoon out some of their wisdom for poor me but they also pick excellent stocks as good as any I’ve ever seen anywhere else – I can’t express how impressed I am with this service.

Motley Fool has a subscriber base of over 1 million people that makes it one of the most popular stock-picking advisory services in America.

The program provides monthly recommendations of stocks and also comes with some extras which include the customer service, access to 30 years worth of archives, unique commentary on global events, interviews with top business minds from around the world, and more. All this along with its diverse stock portfolio make Motley Fool an excellent pick for investors looking to diversify their portfolios.

Motley Fool is a service that tells you what stocks to buy and sell, so you know how to beat Wall Street. Motley Fool’s mission is to show you the way through the markets so you can make your own decisions about which stocks are worth investing in rather than depend on stock analysts or “Wall Street fat cats” who expect different returns for those with high enough stakes. If you are looking for advice to invest in stocks then I will recommend you to go for this site it’s totally worth it.

I was a long-time Motley Fool subscriber from the start. They have something that others just don’t have: intellectual curiosity, vernacular wit, and investment mojo all wrapped into one punchy package. From day 1 they picked growth stocks that actually increased in value; for years I’ve watched this company separate itself from the pack through its savvy recommendations on how to use your money wisely for maximum profit based on their analysis of market cycles and supply/demand issues.

Motley Fool is a powerhouse that consistently makes good money for its traders. It’s important to be considered one of the best and demonstrated so strongly for years – since 2002, actually – which shows it has grasped what investors need: sensible stock picks and tips with successful long-term results against all odds.

Some might argue day trading requires quicker decisions and more aggressive markets, but Motley Fool offers an index service that responds to those needs as well as those who want financial security in the long haul. So whether you do your own research or rely on someone else, Motley Fool stocks could be perfect for you!

So there I was, an uneducated trader trying to figure out how to do well in this complicated world of stock trading. I didn’t know what tools were available for me and there was so much information out there but so little guidance. And then it happened – by the grace of the gods or some heavenly intervention- I found Motley Fool, who has performed excellently well in their financial stock-pick advice since 2002. Most of their stock picks have outperformed the market by at least 25%. From the initial days till March 2018, Motley Fool stocks picked 343% for traders while 79% is returned through S&P 500 doesn’t demand aggressive trading and is not meant day traders. recommended.

Motley Fool is an online investing magazine that offers helpful financial advice, useful information of the market for investors, and personal finance. Previously considered as a cookbook of stocks to buy, Motley Fool now more focuses on providing you with sufficient knowledge about different investment products available in the market so you can make an informed decision. I would highly recommend motley fool to people out there who are looking for the trading guidance.

Motley Fool is a name of the company which provides premium stock-picking advisor service. The best thing about this program is that it offers all stocks picked by hand. Besides, its clients are not required to trade often and they will be benefited from long-term financial market movements. Highly recommended.

Motley Fool aims to provide it’s customers with financial advice and services. They only take a commission for their service, which is much smaller than what other companies would take. Motley Fool reinvested $2 billion in its company and provides customers worldwide with the best customer service they could ask for! Along with an excellent cross-section of stocks, many different types of investments and trades available to each customer. give it a try now.

This site is a one stop destination for those who aspire to invest wisely and be successful in the long run. The Stock Advisor, as it is known, has been helping people become more savvy investors since 2001 by providing timely buy recommendations based on their analysis of stocks that have the potential of being excellent investments over time despite not making you rich overnight or guaranteeing profits. All this without taking short-term risks with your money by playing shooting games with stocks fundamentals. strongly recommended.

If you’re a beginner, then this system is for you. The Motley Fool Stock Advisor email subscription help people stay up-to-date on the latest investing strategies and news while teaching them how to create a diversified portfolio that helps manage risk. I enjoy reading the newsletters because they’re informative and helpful for beginners! and I would recommend to this folks out there who are looking for best stock advisor in the market.

This app is a must for any investors, new or old. All of the information you need to give you an edge on the market is compiled into one easy-access place that allows you to stay up-to-date with advising articles and news moments. With research effectively organized by sector and industry specific, this app has everything a trader needs. I start my day with Motley Fool because there’s always something going on in stocks – it tells me about trends happening now – which helps if I’m looking to buy some shares. For those at a loss as how to approach investing without losing their savings, this app does all the work for them! It analyses shares from over 7000 companies globally so go for this and try it on your own it will worth it.

Motley Fool has been making the life of investors easy with its qualitative and informative insights on stocks. The website is, by far, one of the most popular financial blogs. Thousands of people subscribe to their email service for its candid stock advice and upbeat suggestions. If you’re in it for long-term investments or want some diversified portfolio at your disposal, Motley Fool will be your best friend. It provides a wide range of services including; regular recommendations; Best Stocks to Buy; Motley fool Stock Advisor Email Subscription etc….. if you’re looking for an all rounder Broker this should be your number one option!

It is a smartly named service that brings you detailed reviews and recommendations of stocks.

Motley fool sounds like a company that knows how to make fun even out of their low name – which in turn made me want them more! I would say they are organised, thorough, trustworthy sensible people who don’t promise too much but gives everything they have the potential to produce to give us great advice on what stock should be held for longer periods of time. They offer honest assessments about when it’s good time to sell any particular company or purchase stocks in general. When one reads this service, they will know whether it is worth investing money in this organization because motley has our backs! It’s easy with Motley’s help to never feel lost. recommended.

Motley fool sounds like a company that knows how to make fun even out of their low name – which in turn made me want them more! I would say they are organised, thorough, trustworthy sensible people who don’t promise too much but gives everything they have the potential to produce to give us great advice on what stock should be held for longer periods of time. They offer honest assessments about when it’s good time to sell any particular company or purchase stocks in general. When one reads this service, they will know whether it is worth investing money in this organization because motley has our backs! It’s easy with Motley’s help to never feel lost. recommended.

I played with the app for a few minutes and this is what I like: you can choose up to five stocks, in any combination of sectors. It also includes stock charts and dividends earned over time—handy information when deciding which stocks to plunge into.

The Stock Advisor email alerts are very helpful, not overly frequent but just enough so that I can keep an eye on my favorite shares without feeling overwhelmed by updates.

It also comes with pre-made data scripts that allow me to spend less time worrying about averages and more time making sure we’re getting our dough worth out of them Crazy Investors%.

Motley fool is an excellent place to invest your money because it’s the best way to diversify. They will never tell you to buy quick rich schemes, but instead try to help you be secure in your investments. You’ll love their email service which gives you helpful advice on stocks all the time! you should definitively give it a try.

The Motley Fool is a website that spans from general investing advice, to financial news and global coverage. The site’s goal is that it will “teach you how to grow your money without getting hurt in the process. The Motley Fool provides recommendations on stocks worthy of investments with the Quality series which gives an in-depth analysis for each recommended stock providing a list of buy ratings, neutrals and sells.

In addition they have their Disclosures series where they give their thoughts about individual stocks, company breakdowns and updates to various industries. Their in-depth research is great if you want sound investment advice in the early stages so you can get on board before everything takes off .

Motley fool is a user-friendly stock advisor service that takes your hand, and walks you through how to maintain a diversified portfolio of stocks by email. This app doesn’t make any guarantees or promises, but if thats what you want this isn’t for you.”

“If simplicity works best for you, then motley fool has got your back! With an ever upward growth in their loyal customer base who rave about the ease with which they were able to set up accounts on the website and keep track of their investments via email subscriptions!”

Motley fool is a very interesting service which brings you the most promising stocks. They offer intensive research which allows you to make better decisions about your stock market investments and they’ll stay on top of any changes in the market.

If you’re interested in getting started as an investor, Motley fool will make it easy for you to find out what companies might have future growth potentials! You can casually enjoy reading their recommendations every day or just subscribe for email updates if that’s how you prefer to get them.

I have been a subscriber to the stock advisor for over 3 years and I must say that their advice has really helped me make intelligent investment decisions. The mix of services they offer is designed carefully and consistently provides diversified portfolio opportunity at all times. Not only do you get stocks recommendations, but also updates about other products like bonds and forex which can provide great diversification opportunities in your portfolio. Although their newsletter doesn’t promise fast returns on the trades, if you work hard enough, then this service will definitely come in handy!

Motley fool has been around since something 90’s, and they coach their readers to build a diversified portfolio. The service is worth the money considering how it’s helped me reach my goals without getting too high on any one stock.

The company includes an email subscription that provides regular recommendations for stocks, as well as advice of all sorts. For people who are new at this, I recommend it wholeheartedly!