We Got Everything

You Are Searching For!

SUCCESS STORIES

We Got Everything You Are Searching For!

- Find profitable niches easily

- Find profitable niches easily

- Discover easy to rank for keywords

- Discover easy to rank for keywords

Latest Blogs

New From AffiliateBay

We help you keep up with articles featuring in-depth reviews, expert insights, and exclusive tips on the latest affiliate marketing strategies, tools, and trends.

How to Pitch for Guest Blogs?

SEO Friendly Pagination 2024: Best Practices To Be Followed

9 Best Legal Affiliate Programs In 2024 To Earn Passive Money

5+ SEO Tactics To Boost Organic Traffic & Rankings In 2024

What Are Anchor Texts 2024? How To Write A Good Anchor Text?

Guides

Turning your ideas into reality means working on the technical parts. This is when your blog really starts to come together.

Affiliate Programs

Here are the lists of best affiliate programs that you can join and monetize your website as per your niche.

Popular Niche Business Tools

Semrush

5/5

SEMrush is a comprehensive SEO and marketing tool for research, analytics, and optimization of online strategies.

Jungle Scout

5/5

Jungle Scout is an essential Amazon seller tool for product research, tracking, and data-driven decisions to boost sales.

Bright data

4.9/5

Bright Data is a versatile web data collection platform for businesses, providing reliable and ethical data harvesting solutions.

Thinkific

5/5

Thinkific is a user-friendly online course creation and management platform empowering educators to monetize their knowledge effectively.

Explore More Categories

Take The 28 Day SEO Challenge Now

Steal Your

SEO STRATEGY

Download my 2x intelligent spreadsheets to steal your competitors SEO strategy now!

Take The 28 Day SEO Challenge Now

The 7 Day Ecommerce SEO Strategy To Increase Your Search Traffic!

Download my 2x intelligent spreadsheets to steal your competitors SEO strategy now!

What Our Readers Say About Us...

Hi, from AffiliateBay Team

We’re a team that runs successful affiliate websites, and we’re here to share what we’ve learned. Our team shares practical tips and advice for successful affiliate marketing based on our experience in running affiliate websites. We review various products and services, providing unfiltered opinions to help you make informed purchasing decisions.

POPULAR CONTENT

Browse Our Categories

HOSTING

Looking for a new web hosting? Now save a great deal of money using our special coupon codes and deals on the most popular hosting platforms.

EDUCATION

Learn about the top online courses and test preparation. Explore the best deals and honest reviews of popular education platforms and courses.

SOFTWARE COUPON

Get today’s best deals and offers on popular software, services, and online platforms. Save BIG with our new updated coupons.

REVIEW

Explore the word of latest technology with help of our in-depth guides on trending gadgets and tools.The Best Of Affiliatebay

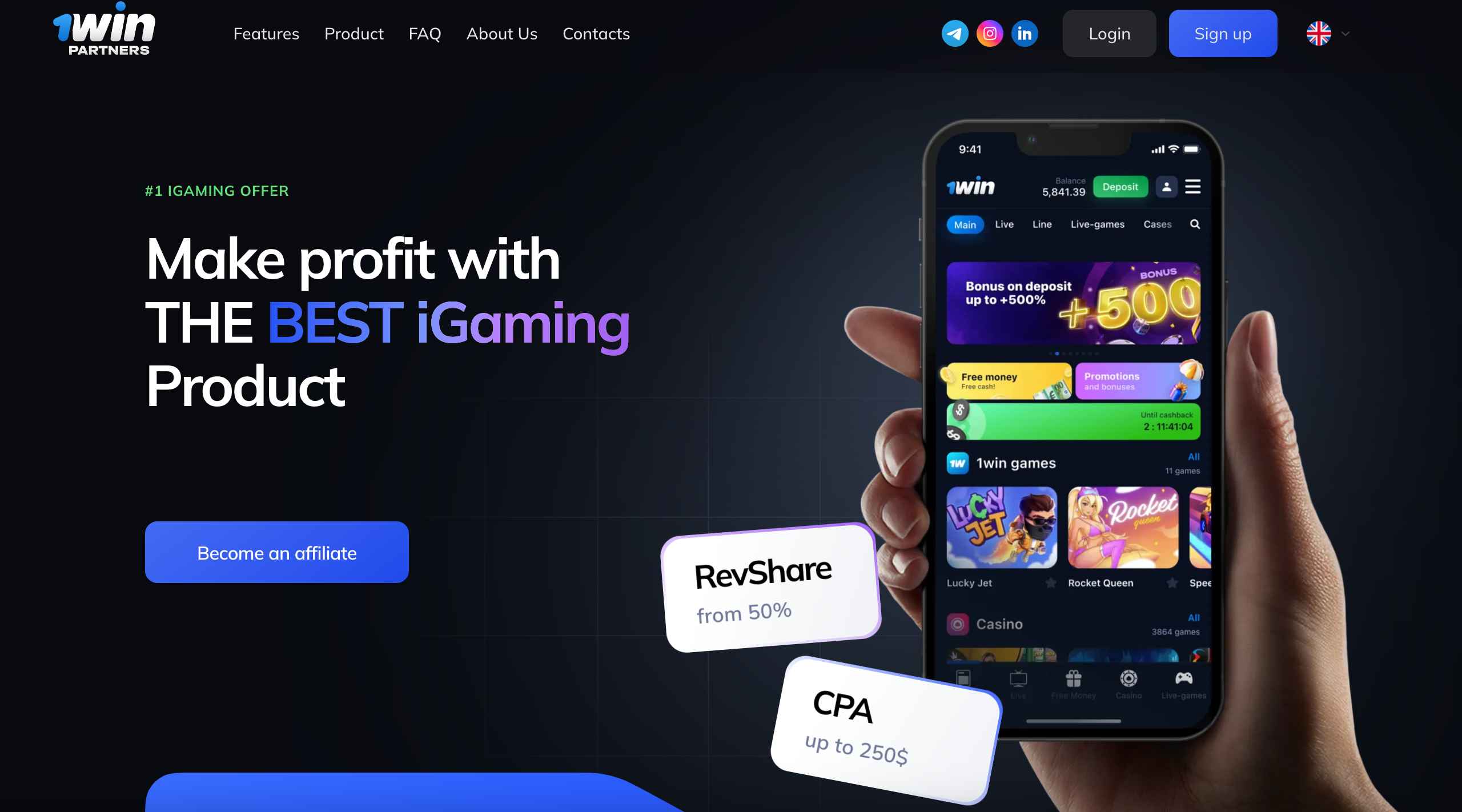

1Win Affiliate Program Review 2024: High Paying Affiliate Program?

Updated on: January 21, 2024

Tai Lopez 67 Steps Program Review 2024– Everything You Need To Know

Updated on: August 11, 2023

My Millionaire Mentor Review 2024– Is It Legit Or A Scam?

Updated on: August 31, 2022

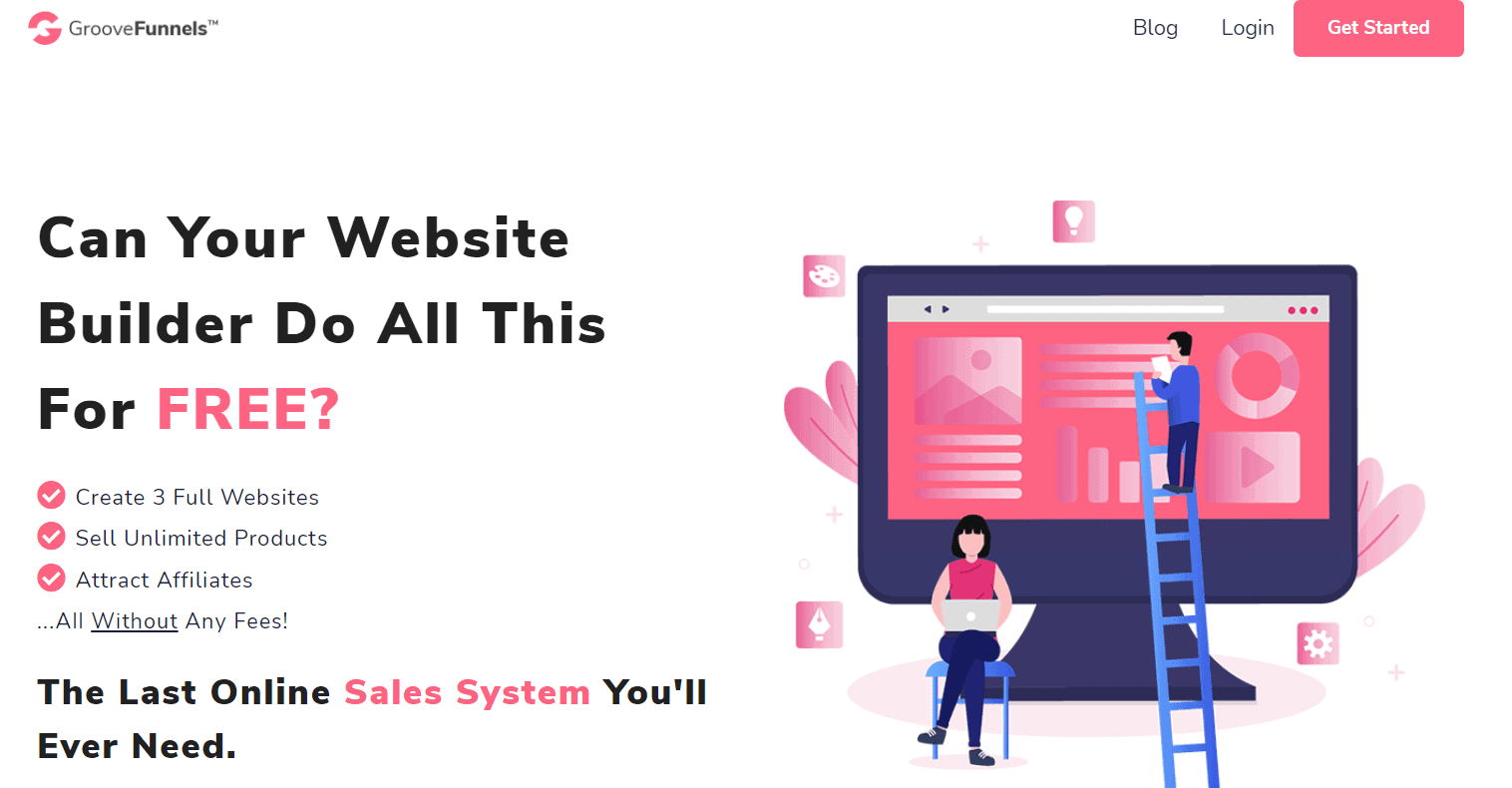

GrooveFunnels Review 2024– Is It Best Funnel Builder?

Updated on: July 31, 2023

Tai Lopez Course Review 2024: Is The 67 Steps Program Worth It? Is Tai Lopez Course Legit?

Updated on: July 28, 2023

How To Become An Affiliate Marketer In 2024?- 5 Easy Steps To Get Started

Updated on: January 11, 2024

How BrandPush Has Helped AffiliateBay in Increasing the Conversion Rate by 48%

Updated on: June 11, 2023

How To Find The Best Affiliates For Your Affiliate Program?

Updated on: June 9, 2023

Affiliate Marketing and VPN: Why Are They a Great Match?

Updated on: June 30, 2023

5+ Best Affiliate Programs That Pay Daily In 2024– Make Passive Income Online

Updated on: February 10, 2024

Become an Affiliate Marketing Pro With Adsterra’s Free Crash Course

Updated on: August 2, 2023

Inmotion Hosting Pricing | How much does InMotion cost?

Updated on: September 4, 2023

Bigrock Hosting Pricing 2024 | Does BigRock offer hosting?

Updated on: September 22, 2023

WPX Hosting Pricing & Plans 2024: Does WPX provide good value for money?

Updated on: July 29, 2023

Namesilo Alternatives 2024– Handpicked For Your Business Needs!

Updated on: August 30, 2022

HostingRaja Review In Detail 2024– Features & Pricing Worth it ?

Updated on: July 17, 2023

Best Web Hosting Service Providers In Singapore (@ $2.95/mo) 2024

Updated on: September 11, 2023

10 Best PPV/CPV Networks For Advertisers & Publishers in 2024

Updated on: August 9, 2023

BizzOffers Review 2024: Is It The Best Affiliate Network For SAAS Products?

Updated on: November 17, 2023

9 Best Crypto Ad Networks in 2024: Best Crypto Traffic Sources

Updated on: August 9, 2023

ADSTYLE Review 2024: Best Native Advertising Network For Publishers?

Updated on: September 22, 2023

Prime Ads Review 2024: Best Crypto Affiliate Marketing Network?

Updated on: September 1, 2023

19 Best Affiliate Networks For Earning Passive Income 2024

Updated on: September 25, 2023

Top 15 Best Lifestyle Blogs 2024 : Model For Success

Updated on: August 11, 2023

How To Write An About Me For A Blog 2024 : 6 Easy Steps to Introduce Yourself

Updated on: August 30, 2023

How To Start Mom Blog In 2024?- Earn Passive Income Now

Updated on: March 19, 2024Difference Between Post And Page In WordPress 2024: Beginner’s Guide To WordPress

Updated on: June 4, 2023

When to use Bold, Italics and Underline in Your Blogs : Best Writing Tips

Updated on: June 4, 2023

How To Promote Your Blog In 2024?- Verified First-Hand Tips & Tricks

Updated on: June 8, 2023We have been featured on